By Thad Currier

Product Marketing Manager

John Deere Financial

If you bought new or used equipment last year, you could get a break when you file your 2012 tax returns.

In late 2012 Congress passed the American Taxpayer Relief Act (ATRA), averting the automatic tax increases and spending cuts known as the ‘Fiscal Cliff.’ While opinions differ on the implications of this last-minute law, it does contain provisions that can help businesses save thousands of dollars in tax liability.

Depreciation is a tax deduction that allows businesses, including logging businesses, to recover the cost of capital expenses, like logging equipment. Depreciation is an allowance for wear, deterioration or obsolescence of equipment. Typically, you would spread the depreciation over six years. The new law lets you front-load some of that depreciation to get up-front benefits.

Accelerated/Bonus Depreciation

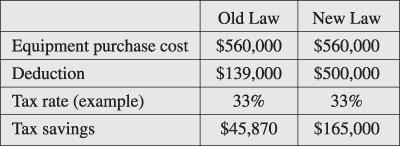

The first provision of the law lets you take a greater depreciation deduction on new and used equipment by raising the limit from $139,000 to $500,000. In other words, your deduction limit has more than tripled, and you can reduce your 2012 taxable income by a significant margin.

To illustrate this provision, let’s say you spent $560,000 on new and used equipment in 2012. Under the new law, you can deduct $500,000 of that, resulting in a tax savings of around $165,000, depending on your tax rate. In the table below, you can see the difference in your tax savings.

In addition to the accelerated depreciation, the ATRA also allows you to take a 50% bonus depreciation for new equipment purchases. Using the example above, this could net you an additional $10,000 or more in tax savings.

Plan For 2013

The Fiscal Cliff law is designed to create movement in the economy by saving businesses money in the short-term. It is retroactive to 2012, but it also applies to 2013, so keep it in mind as you plan your equipment purchases this year.

The money you save can be re-invested in capital improvements, expansion projects and more. So be sure to plan to use that money wisely.

Limitations

As with any tax law, there are limitations of which you should be aware. First, the total investment is capped at $2 million, so anything you spend over that amount reduces your tax deduction. Also, the IRS frowns on businesses buying most of their equipment in the fourth quarter (Mid-Quarter Convention) in order to get the deduction.

Every business and every situation is different. Be sure you consult with a qualified tax advisor to determine how these tax-saving opportunities apply to you.

Currier holds a BS in Commercial Economics from South Dakota State University. He works at the Construction & Forestry Marketing Div. of John Deere Financial, where he has spent 20 years working with the forestry division.