IP Closure Announcement Continues Huge Market Shift

The pulp and paper industry continues its painful supply side market shift as officials with International Paper in late October announced the company will permanently close its containerboard mill in Orange, Tex., and will permanently cease production on two of its pulp machines—the #20 machine in Riegelwood, NC and the #4 machine in Pensacola, Fla.

In addition to affecting 900 jobs, the move eliminates an estimated 5 million green tons of wood fiber capacity across three mills. It also reduces IP’s containerboard capacity by 800,000 tons and IP pulp capacity by 500,000 tons. Once the closures are complete, IP’s remaining containerboard mill system in North America will include 17 mills with an annual production capability of 13MM tons, and the company’s remaining pulp mill system will include eight mills with an annual production capability of 2.7MM tons.

The announcement comes as the pulp and paper industry continues its shift away from containerboard and also away from roundwood raw materials. Since January 2023, at least seven permanent U.S. mill or machine closures have been announced, according to a recent report in the Fast Markets-RISI North American Woodfiber & Biomass Markets newsletter.

The cumulative impact of pulp and paper facility closures across North America on the timber industry and its raw materials supply chain is historic and can’t be overstated, the newsletter states, as an estimated 15 million tons of roundwood and chip consumption have been taken off the market in 2023—about 17% of total wood consumption in 2022.

The newsletter notes that beginning with five announcements in 2020, during the past four years there’s been a total of 22 major U.S. pulpwood mill and machine closures that have taken a cumulative 30 million green tons a year in log and chip consumption off the market.

Latest News

Helene Hammered Private Timberlands

Based on preliminary damage assessments conducted by the Georgia Dept. of Agriculture, the Georgia Forestry Commission, and the University of Georgia, Hurricane Helene left behind an estimated $6.46 billion in damage to Georgia’s agriculture and...

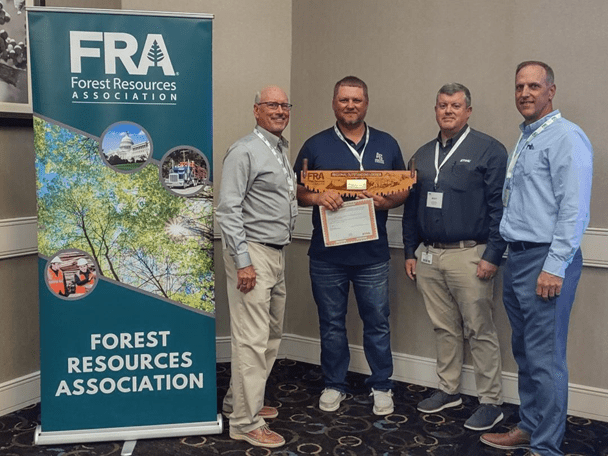

Aaron Street Recognized As FRA’s Appalachian Region Outstanding Logger

The Forest Resources Assn. (FRA) has honored Aaron Street of Aaron Street Logging from Sinks Grove, WV, as the 2024 Appalachian Region Outstanding Logger Award winner at FRA’s 2024 Joint Appalachian & Southeastern Region/Forest Products...

Have A Question?

Send Us A Message