Pumpin' Pain

Article by David Abbott, Managing Editor, Southern Loggin’ Times July 2022

This month I was determined to find out how rapidly increasing fuel prices are impacting the logging industry, so I reached out to a lot of the people I know. I got enough responses to fill the whole issue, but I only have a page available, so I was forced to cut out a lot of really good observations. Here we go.

“Inflation rate for logging here is anywhere from 38-42%,” says Crad Jaynes, head of the South Carolina Timber Producers Assn. “Quite a few contract haulers have said to hell with it. In my 45 years it is the worst I have seen it.”

South Carolina logger Bob Lussier and Alabama Loggers Council Director Joel Moon have both also been in the industry close to 40 years, and agree with Crad’s assessment. “I’ve never seen anything quite like this,” Moon says, while Lussier notes that he’s seen five economic downturns in four decades, but never before such a rapid escalation of costs.

Carolina Loggers Assn. Executive Director Jonzi Guill says she has not talked to a logger recently who isn’t considering downsizing crews or selling equipment. “Our loggers are hurting bad.”

“We seem to feel it much quicker because, unlike on-road truckers who can push added cost on to consumers, we don’t have anyone to push that cost to,” says Toni McAllister, Executive Director of Louisiana Loggers Assn. “We can’t pass our costs on so it feels like it is only our industry suffering, but it is not. It hits us first but it will be all over the U.S.”

“It is devastating to the logging industry,” one Mississippi logger commented anonymously, then summed it all up succinctly: “The margins were already tight but you factor in the diesel prices along with the inflation of every other thing we use in our business, it’s a nightmare. I’m afraid the cost of fuel is gonna put a lot of loggers out of business. We have seen a little help from mills but when you’re getting a 3% bump and you’re seeing 40% inflation…even us ole dumb loggers can figure that math out!”

Within the industry, the big mill companies, with greater assets and deeper pockets, can forestall catastrophe by paying more (although there is only so much they can do). American Loggers Council director Scott Dane predicts that, if mills don’t step up, the loggers will run the numbers and be forced to make the hard choice of parking their machines.

Politically, both ALC and President Biden have called for a temporary suspension of federal and state fuel taxes. ALC is also requesting a temporary allowance of untaxed off-road diesel for on-road use, and for log trucks to have access to interstates, to increase fuel efficiency.

Those things could help, some, if they happen. But the only real solution is a market one: demand has to go down, or supply has to go up. Bill Jones, Assistant Director, Southern Loggers Co-op, says things will remain tight until more oil starts being produced in refineries. “It’s not a good situation and I don’t see it getting any better until maybe the fall,” he predicts.

Moon thinks not even then. “The fall is gonna be worse, in my opinion.” His reasoning: fuel prices stay high, but wood products demand declines (consider the Fed’s recent interest rate increase and the effect on housing). Right now maybe mills could pay more; then, maybe they can’t. “Lumber has rolled back a little already and paper usually follows about six months later,” Moon points out. “I think there is a crisis a-coming.”

Supply, Demand

“We are in a challenging situation, with inventories running low at all the terminals across the whole United States,” Jones warns. “We have less than 12 days of inventory in the whole system.”

SLC President/CEO Todd Martin adds, “We have never witnessed the markets move in the way they have moved over the past year, especially since the beginning of this year. It makes it difficult for us to manage and even more difficult for our members to survive. From all indications we are hearing that crude will reach $140 per barrel by the fall.”

Jones goes on to explain, “What has happened on the world market is that the European Union has finally agreed not to buy any more fuel from Russia; they should not buy a drop by the end of the year. There is kind of a weaning off period, but it is putting more pressure on what inventory we have.” He doesn’t expect Saudi Arabia, Venezuela or Iran will release any from their reserves to help.

“If we don’t start producing some pretty soon we will continue to tighten our grip on our inventory and there will be a bidding war for whatever is in those tank farms across the country,” Jones continues. “I don’t expect it to slow down and we might even see some rationing by the middle of the summer. Allocations are tight. Loggers hate the high price but they really don’t like it when they run out.”

Martin reports that SLC has already experienced supply difficulties, especially on the East Coast, and recently in Alabama too.

Despite the high prices, the volume of fuel purchased has not diminished yet. Some SLC stations are posting record days in terms of number of gallons pumped. That’s an upside for members: the co-op has big dividends going out. “The SLC saves our members dollars at the pump, and we also give back,” Martin says. “Each year 100% of the SLC’s net profit is paid back to our members in the form of patronage dividends.”

Jones adds, “We are moving over 200,000 gallons a day and it means something to the logging community that they have a stake in their fuel supply.”

Meanwhile, in June the U.S. Department of Energy announced an allocation of $59 million to accelerate the production of biofuels. “The breakthroughs from this funding will support President Biden’s and DOE’s goals of advancing the use of bioenergy, achieving cost-competitive biofuels, and reaching a net-zero carbon economy by 2050,” a DOE statement reads.

“We have some people in the White House that are dead set on seeing us go to green energy,” Jones points out. “A lot of this is politically charged, I think, to drive us more towards renewable fuels and electric cars, which the grid cannot handle a great influx of.”

Going Or Gone

“(We) can’t do what we are doing much longer,” another anonymous logger fears. “I just got through running my P&L for the last five months and am losing $3,500 per week. Not only fuel but everything else costs so much: repairs, parts, tires, etc. Can’t and will not continue to lose money like this.”

It’s not just fuel; general inflation, labor, insurance, equipment, parts, delivery delays, it’s all of it. “Fuel is the main issue but we have had hyper inflation for the last 10 months or so, on every product we buy,” Louisiana’s Josh McAllister says.

His wife, Toni, Executive Director of Louisiana Loggers Assn., notes, “We have lost multiple loggers who decided to walk away because of machine breakdowns causing them to be down production for weeks and months before they could receive the parts, and they literally couldn’t afford to sit that long.”

Supply chain delays were already crushing this industry, so in Toni’s estimation, exorbitant fuel prices were just the straw that broke the camel’s back. Now, she says, loggers are dropping like flies. One timber dealer, she reports, recently lost four his nine crews in a week.

“Inflation will kill us slowly; this fuel will kill us this month,” North Carolina logger Brent Roberson warns.

With reports of loggers racking up credit card debt to keep going, Bob Lussier, owner of Great Woods Companies, LLC, Bennettsville, SC, warns, “It is unsustainable. We are losing a few now but in the next 60-90 days we are going to lose a lot,” he fears.

Tim Rodrigues of Rodrigues & Sons Logging in Texas is among those who have found the current situation untenable. He says he has parked or sold most of his equipment rather than continue producing at a loss.

According to Rebecca Pipkin at Mark Pipkin Logging, Arkansas, “We had logged for over 20 years but can’t continue to lose money in this industry. We are no longer logging due to everything going up but our pay.”

Lussier, who serves as President of TEAM Safe Trucking, is already shedding excess equipment and admits he is among those strongly considering the possibility of hanging it all up if something doesn’t change. “I’m not going to keep losing money. When I was younger I had to take money from my savings to keep my business afloat, but I am to the point now I am not going to do that anymore.”

Like Lussier, the McAllisters understand why North Carolina’s Bobby Goodson made his decision a few months to retire early. Toni’s dad, the patriarch of their family business, McManus Timber, is making similar calculations.

This is all no surprise to Richard Schwab at Florida’s M.A. Rigoni. “I think with Bobby going out, he and Lori have inspired a lot of people in that place in their life and career to strongly consider whether they want to re-up in this business climate,” Schwab observes.

“It is a global crisis that is going to be hard for a lot of us to sustain,” Josh McAllister asserts. “We can survive longer than a new company because we have equity built into our business. But we are starting to not break even. So we have to find where the stopping point is; when do we quit using up all our equity? Because that is not a sustainable business model.”

“You don’t want to get to the point of having to dig into retirement savings to make payments,” Moon says. “The company has to support itself.”

“We’ll see what happens sooner than later, but people are folding every day,” Toni adds. “It’s going to put everyone out of business.”

Numbers Game

“The most important thing loggers and truckers need to do is know their numbers, how much more inflation and fuel is costing in the woods and from the landing to the mill,” Scott Dane of American Loggers Council advises. “Once they establish that then it is up to them whether they are satisfied with what the mill is paying or not.”

Lussier agrees. “Loggers need to know the difference between NO and KNOW,” he recommends. “If he knows what his costs are, he can say NO I won’t work for that rate.”

“I think I am seeing in some instances loggers walking away from jobs that would not be profitable to them,” Moon notes.

When logger Brent Roberson was a highway contractor, he worked on a fuel index in which haul rates fluctuated to match fuel costs. “This system is one that is used around the country in the highway market, but unfortunately for us, is not applied in the logging industry,” Roberson says. He suggests a similar index can help loggers and mills calculate adequate logging rates.

Guill says, “The CLA has developed cost calculators to try and help our loggers be able to calculate their cost with the increase in fuel price.” Other groups have been doing the same; for instance, Virginia Loggers Assn. commissioned Dr. Joseph Conrad, Assistant Professor of Forest Operations at the University of Georgia’s Warnell School of Forestry and Natural Resources, to conduct a fuel cost analysis and develop a fuel adjustment formula.

Buck Vandersteen, director of Louisiana Forestry Assn., suggests, “In order to survive we have to ask, do I take a tract that is 80 miles away or decline it for one that is closer but worse timber?”

In a recent letter for ALC, Lussier wrote, “When fuel prices began to rise back in February I really started looking closely at our company’s expenses. An individual in another state shared a cost calculator with me that their association uses to help their loggers. We gathered the information necessary for the analysis and ran the numbers. Not only did we want to know what our costs were, but also to be able to show the mills what our costs were. We were very surprised to see how the expense numbers rapidly increased with fuel prices affecting our operating costs.”

Lussier found that his fuel expense for the first six months of the year have increased by 57% over the same period last year, while production is down 30% due to quotas.

“We tried to meet with some mills to show them the findings of the calculator, and to our dismay, some didn’t even want to talk about it, and others who have looked at it seem to have no regard.”

Too Little, Too Late

What can be done? “These mills gotta come off it,” Lussier states. “It’s sad that they can all show record profits, but they can’t pass it down to their supply chain that is struggling.”

It is hard, the McAllisters concur, for loggers to see the CEOs of some large, publicly traded companies they work for talking about immeasurable profits and paying billions in dividends to investors, while their suppliers are contemplating having to park or sell their equipment and let go of employees who have been with them for decades, leaving those families without an income. “That is a hard pill for loggers to swallow,” Josh acknowledges.

Toni adds, “We know we are the bottom of their supply chain but they still can’t have that product without us.”

Guill says, “As an association we want to do all that we can to help our loggers succeed, but…until we get some help back from the mills I honestly do not know how long our loggers can maintain.”

Many loggers assert that they can’t make up the difference in production anymore because of quotas. “Inventories are still high at mills, so many loggers are not getting a full week of work,” Vandersteen acknowledges. “Loggers are frustrated with mills; mills are in an awkward position. They have made money, but a lot of it has been reinvested in plant improvements and new plants being built and that is critical for them to stay operating. But a lot of people wonder: could they have done more to help the logging side of the industry?”

In North Carolina, Guill says, “Mills are showing up to the meetings and want to hear what the loggers are saying. The mills have had the upper hand for a long time, and the loggers have worked for years without increases, but this fuel increase is the straw that broke the camel’s back. Some mills have stepped up and offered surcharges, but a lot have not.”

Sources in multiple states report that many mills and timber companies (not all) are in fact paying fuel adjustments, but it usually comes too little, too late. And in some cases, the adjustment came with a cut in delivery price, defeating the purpose.

This industry has changed in 45 years, but in other ways, it hasn’t changed a lick, Crad Jaynes lament. “As long as trucks are going across the scales, they think everything must be lovely…but every load is losing $100 or more,” he says. “It is just so discouraging. I want them to make a profit, but they have been making record profits on the backs of the suppliers and forestland owners.”

Lussier agrees. “It’s the old southern adage: we have wood in the yard, there’s trucks lined up, there ain’t no problem.”

“If you are a logger today and you are relying on a mill to give you what you need without asking for it, you’re not gonna get it,” Schwab counsels. “Loggers have got to stand up and demand it. They’re not volunteering to do anything.”

“Some just want to see how low they can get the price of wood delivered,” Vandersteen points out. “That is a bean counter, somebody who wants a feather in their cap for lowering cost but doesn’t realize the harm they are doing long-term.”

Schwab believes, “The days of trying to push people to do it for less are over. We can’t afford it.”

Like many industry observers and participants, Moon wisely hopes the situation doesn’t deteriorate into loggers and mills fighting each other. That, he believes, would ultimately prove counterproductive for all involved. “Loggers and mills are partners,” he asserts. “We’re all in this together.”

Politics

Some express an exasperated hope that they can just hold on till the end of 2024, when they hope to see an administration change. But even after the next election, Lussier points out, it will take a long time to fix what seems to have been broken.

Moreover, while many in the industry lean to the conservative end of the political spectrum, that doesn’t mean they blindly trust Republican politicians to do the right thing. Some suggest that, though they may view Democrats as clueless or incompetent, they fear that Republicans, in some cases, may actually want to keep things bad, to better their chances of winning in upcoming elections.

“I can’t be mad at Biden,” Lussier says. “He is doing exactly what he promised to do. But I am mad at Republicans because even though they are not in the majority they are just sitting back and letting it happen. We don’t need to drain the swamp; we need to flush the toilet.”

Lussier continues, “To blame just the Democrats is not fair. What are the Republicans doing about this? This party division has got to stop. We are ALL Americans.”

Latest News

New From Komatsu: PC230F-11 Processor

Forestry crews need equipment that can deliver exceptional performance in difficult environments. With the fuel-efficient Komatsu PC230F-11 processor, operators can control downtime and drive productivity with this processor’s ability to delimb…

Collision With Train Injures Log Truck Driver

BACKGROUND: On a spring morning in the Southeastern U.S., a log truck driver was starting to transport his second load of the day. Weather was not a contributing factor to the accident as conditions were clear and dry. PERSONAL CHARACTERISTICS: The…

Report: Southeast Longleaf Pine Stands Still Expanding

America’s Longleaf Restoration Initiative recently released its 2021 report on activities to maintain and increase stands of longleaf pine throughout its traditional range across nine states in the Southeast U.S. Activities across all forest…

What’s Next?

As I look at my little boys I often think about what’s next for them; how can I set them up for success? Is playing ball their future? Am I doing right by forcing them to eat zoodles? In my personal life, in the daily grind, it is easy to see how fast (and slow) time moves. I know one day I will no longer be my kids’ taxi service and will be ugly crying at their high school graduations. But that’s expected: the natural order of time marching on.

Enviva Establishes Heirs Property Fund

Enviva Inc., the world’s largest producer of industrial wood pellets, has announced the establishment of the Enviva Heirs Property Fund (EHPF), an initiative dedicated to ending involuntary land loss across the U.S. Southeast. Enviva has formally…

Paper Excellence Group Buys Resolute Forest Products

The Paper Excellence Group (PEG) has signed a deal to buy Resolute Forest Products Inc. in an agreement that values the company at $2.7 billion U.S. In a statement, Patrick Loulou, PEG chief strategy officer, said Resolute is an ideal fit for the…

Lumber Markets Keep Growing

Teal Jones Group marked the beginning of construction of an $110 million SYP sawmill near Plain Dealing, La. on July 11 with a groundbreaking ceremony. Canada-based Teal Jones Group had disclosed in December it was…

PotlatchDeltic Redoing Waldo

PotlatchDeltic Corp. is investing $131 million to expand and modernize its sawmill located in Waldo, Ark. The project will increase the mill’s annual production capacity from 190MMBF of southern yellow pine dimension lumber to 275MMBF. The company…

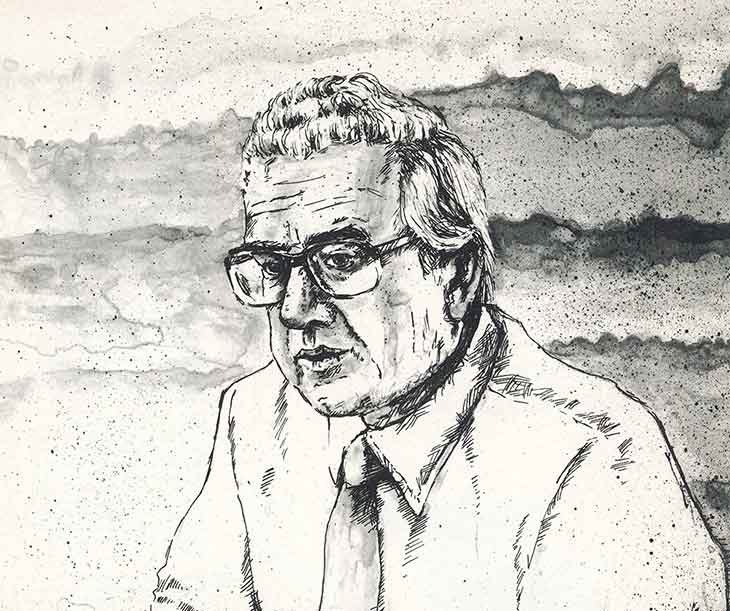

Weyerhaeuser Led Company Through Key Years

George H. Weyerhaeuser Sr., who served as president and CEO of Weyerhaeuser Co. from 1966 to 1991 during an exciting period of wood products development while encountering new timber supply challenges brought on by an aggressive environmental…

Have A Question?

Send Us A Message